About Us

BayCoast upholds the time-honored belief in community involvement and provides a wide range of financial services. We are your friends and neighbors, dedicated to supporting the communities where we live and work. We offer a wide range of financial solutions to suit your life and your lifestyle. Afterall, you have financial goals, and we’re here to help you achieve them.

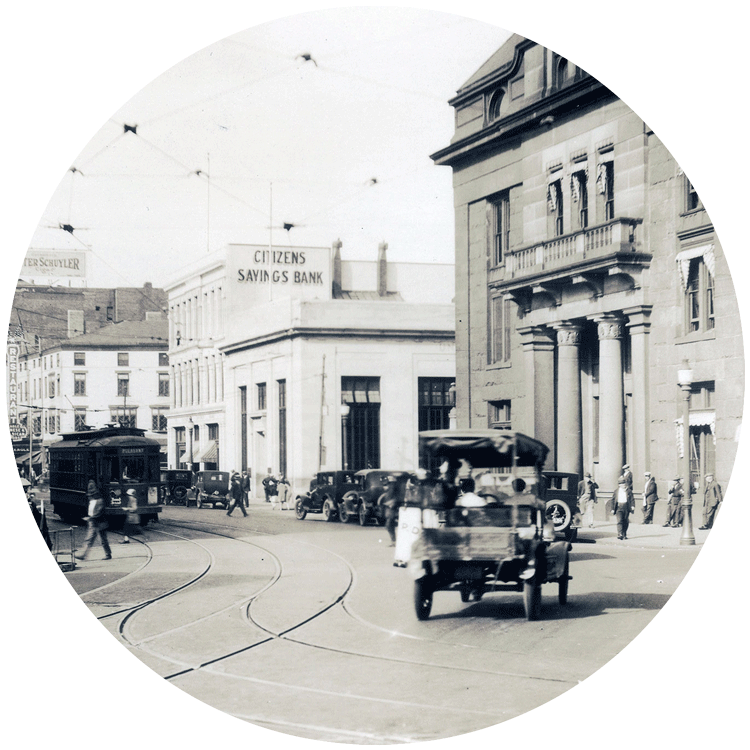

Our History

BayCoast Bank is a long-standing community bank, serving customers since 1851. Originally chartered in Tiverton, Rhode Island, BayCoast Bank started out simply as The Savings Bank, opening its doors on December 1st of that year. In 1862, a state boundary shift placed The Savings Bank on the Massachusetts side of the line, making the city of Fall River its home for well over a century, before relocating its headquarters to Swansea in 2011.

We are incredibly honored by our decades-long tradition of financial services to the area. Today, this commitment is as strong as ever, and it is our privilege to continue to provide exceptional service to you, as we did for your parents, grandparents, and great grandparents.

Our Mission

At BayCoast Bank, it is our mission to provide exceptional service and solutions for our community.

Our Values

As a BayCoast employee, I will:

- Have a positive attitude

- Take pride in what you do

- Care about people

- Believe what I do is important

Our Commitment to Sustainability

At BayCoast Bank, we are deeply committed to building a sustainable future for our organization and the communities we serve on the South Coast. Sustainability is an important practice that’s essential for protecting our natural resources, fostering a greener, healthier environment. Our organization’s four core initiatives for sustainability include: safe disposal practices, waste reduction, optimizing water use, and efficient energy consumption. By integrating eco-friendly practices, we aim to minimize our environmental footprint and contribute to a healthier, more sustainable world for generations to come.

To learn more about how our BayCoast organization is working towards a greener tomorrow, please click on the drop downs below.

We are ensuring the safe disposal and recycling of electronic equipment, printer cartridges, toner cartridges, and other hazardous materials, minimizing their impact on the environment. We have also taken significant steps to reduce waste by eliminating Styrofoam use across all our facilities.

We have implemented water-efficient irrigation systems across all our operating facilities and branch network, reducing water consumption by two-thirds annually. Looking ahead, we are planning ecological and lawn replacement strategies, focusing on the use of native plant species that are better suited to each region’s unique climate and conditions.

About one-third of our annual energy usage has been offset by installing solar photovoltaic panels across 55% of our operating facilities and branch network. To further reduce energy consumption, we have implemented motion-sensitive lighting in offices and conference rooms, ensuring that lights are only on when needed. Additionally, we are in the process of transitioning all office, parking, and carport lighting to energy-efficient LED bulbs.

We have enhanced our recycling efforts, ensuring that office paper, cartons, plastic, glass, and aluminum are properly recycled across all facilities. To reduce plastic waste, we have provided employees with insulated reusable water bottles, encouraging sustainable choices. We are also reducing office paper and toner usage by promoting digital communication, double-sided printing, electronic signatures, and the use of collaborative meeting solutions. We actively encourage customers to help us on our sustainability mission by adopting electronic statements (eStatements) across all Bank products and services.

Our Services

Whether you need to open one a checking or savings account, a certificate of deposit (CD) or apply for an auto loan, we are here to deliver the solutions you need.

Personal Banking Solutions Include:

Business Banking Solutions Include:

2024 Annual Report

Our Family of Services

Here at BayCoast, we’re not just a bank. We’re a family and we want to help you understand your entire financial picture. Through our BayCoast Family of Services, we can help you manage all your financial needs as you work to enhance your financial wellbeing. This includes investment and retirement services, insurance coverage and so much more.

Chartered in 1851, BayCoast Bank is a community bank, serving the people and businesses on the South Coast of Massachusetts and Rhode Island. We offer banking solutions that are Just Right® for your busy lifestyle.

When you need quality mortgage solutions, turn to BayCoast Mortgage Company. We are a full-service lender, providing industry best solutions in residential purchase, refinance, renovation, and construction loans. We have the flexibility to offer superior products and service, making the process easy and convenient.

Plimoth Investment Advisors has a long history of successful portfolio management for both private and institutional clients. We’re focused on creating a personalized and unique experience for each of our clients, helping you develop an investment plan to suit your specific financial goals.

Our Resources

At BayCoast Bank, we know you have questions about a wide range of topics that relate to the financial world. We’re proud to offer additional information that may help you and your family. From financial education programs to tips on internet security, scam alerts, and more, resources are here for you, right at your fingertips. Click below for:

Your Banking Guide

Not sure what financial services you may need? No problem! We have a special questionnaire, designed to help you learn what banking products may be best for your needs. Simply answer a few questions and we can help point you in the right direction!

Customer Support

Need to speak with someone? We’re here to help in any way we can!

Products and services made available through BayCoast Financial Services, BayCoast Insurance and Plimoth Investment Advisors are not insured by the FDIC, DIF or any other agency of the United States, and are not deposits or obligations of nor guaranteed or insured by BayCoast Bank or any of its affiliates. Investment products are subject to risk, including the possible loss of the principal amount invested.